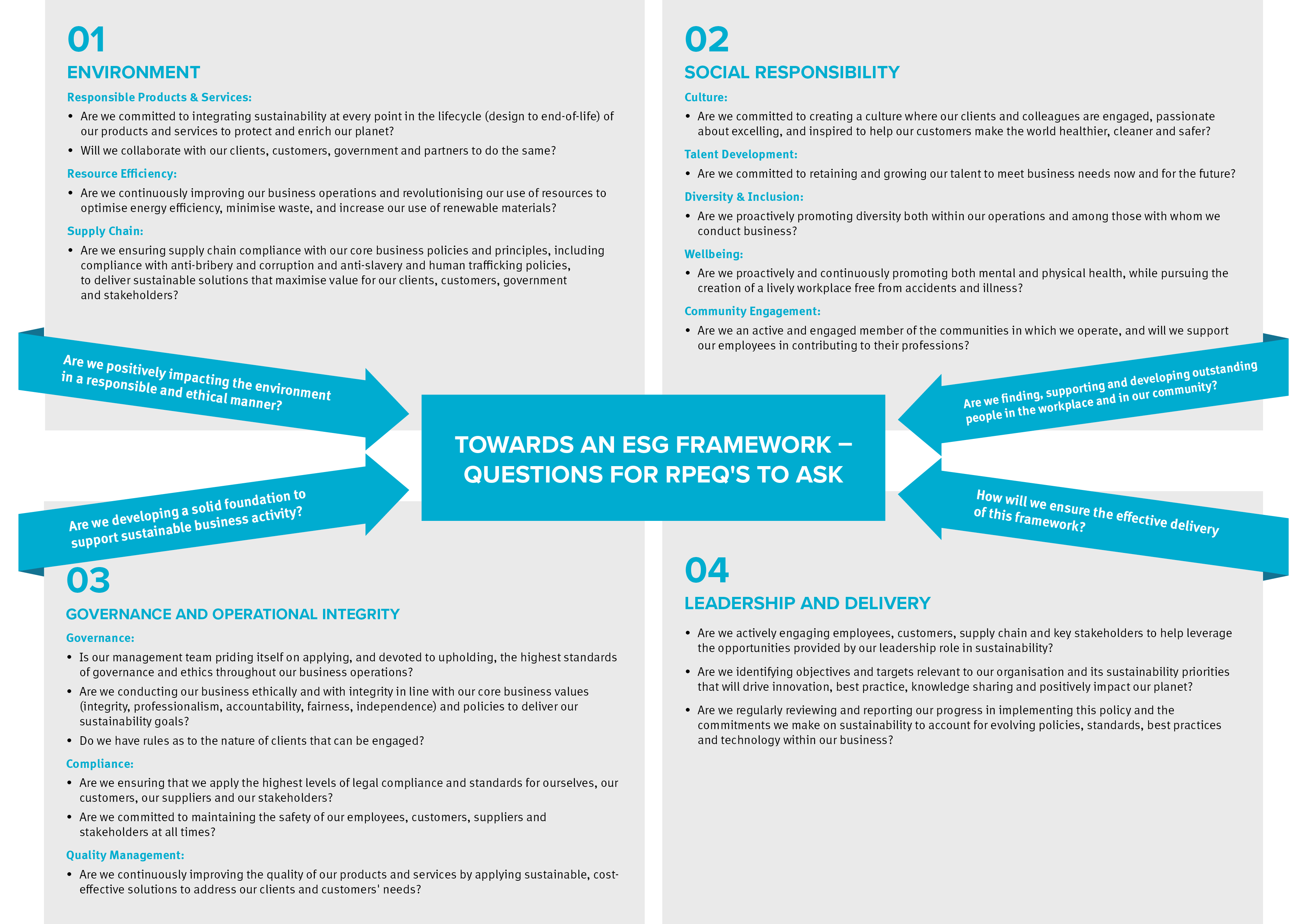

03 Aug ESG and the RPEQ

We should expect an engineering sector-wide transformation, with ESG impact assessment becoming a mainstream requirement for infrastructure investment and delivery, writes BPEQ’s community representative, Christopher Edwards.

ESG IS WHAT?

According to the McKinsey Quarterly[1] environmental, social and governance (ESG) criteria are increasingly integrated into investment analysis, processes and decision-making. These are all categories RPEQs have some degree of oversight of. In just a few years, sustainable or responsible infrastructure investing has moved from a slightly idealistic niche to front of mind. It is a mainstream dimension for governments, investors, and project sponsors and appears to be strongly influencing business case performance, resilience of investment and delivery of capital projects over time.

This is particularly the case in infrastructure, in view of its wide reaching and long-term consequences for the community. In many cases investors and government have not just accompanied the trend but pioneered its evolutions, complementing, or preceding regulatory requirements. A number of engineering, design and project management firms, investors and operators have embarked on communicating their values and sharing their approaches to ESG.

ESG impacts infrastructure capital project lifecycles from development to delivery, operations and through to decommissioning. It is therefore significant for RPEQs to consider the impacts on infrastructure assets and those from infrastructure assets.

E

The ‘E’ in ESG, encompasses environmental criteria including the energy our companies and clients take in, the waste it discharges and the resources they need. It captures energy efficiencies, carbon footprints, greenhouse gas emissions, deforestation, biodiversity, climate change and pollution mitigation, waste management and water usage, as examples.

S

The ‘S’—social— addresses the relationships our companies and clients have and the reputation we develop with people and projects in the communities where we deliver projects and do business. It can cover labour standards, wages and benefits, workplace and board diversity, racial justice, pay equity, human rights, talent management, community relations, privacy and data protection, health and safety, supply-chain management and other human capital and social justice issues.

G

The ‘G’ stands for governance. It refers to the internal systems of practice, controls, and procedures our companies adopt to govern better, make effective decisions, comply with the law and meet the needs of our clients and stakeholders. Governance leads the ‘E’ and the ‘S’ categories— corporate board composition and structure, strategic sustainability oversight and compliance, executive compensation, political contributions and lobbying, and bribery and corruption. [2]

IMPACT FROM INFRASTRUCTURE ASSET

- Infrastructure assets can have a positive or negative impact on the surrounding environment and/or society

- Examples: environmental degradation, pollution, improved access to basic services, health and safety for workers, corruption etc

- Feedback loops, i.e. a reaction from the surrounds back onto the asset may occur, e.g. tax breaks, or societal / community backlash such as strikes, boycotts and unsupported infrastructure

- Financial consequences can be direct or indirect, e.g. via reputational risks

IMPACT ON INFRASTRUCTURE ASSET

- Infrastructure assets may be positively or negatively affected by its surrounding environment and/or society

- Such external impact on the asset is primarily of physical or regulatory nature

- Examples: floods, droughts, (natural) resource constraints, pollution, demographics, riots, regulatory changes etc

- Asset’s resilience to external impacts can anticipate, accommodate, absorb or recover from such impacts

Figure 1: ESG impact on and from an infrastructure asset. Source: adapted from B Capital Partners AG.

ESG AND THE RPEQ OPPORTUNITY

As can be seen from above, ESG includes a range of topics – some of which RPEQs would be surprised are included in the ESG scope. In Queensland, there has traditionally been a solid focus on issues that are part of the environmental scope. While these are not to be ignored, RPEQs should bear in mind the varying issues in the social and governance areas.

The Queensland Government is a steward of the state’s abundant natural, human and capital resources for future generations. It acknowledges the global community’s expectations for Queensland to demonstrate its approach to ESG risk factors and sustainability issues when making decisions about projects, policies and investments. Queensland is well-positioned to mitigate the risks and capture the opportunities presented by emerging trends, such as climate change and decarbonisation, digitalisation, globalisation and trade, and demographic shifts. Ongoing engagement with investors and stakeholders on sustainability issues is a key focus of government’s efforts [4].

‘Queensland is well-positioned to mitigate risks and capture opportunities presented by emerging trends…’

While sector or region-specific ESG frameworks have not yet been mandated by Australian governments or regulators,

those frameworks that are currently available provide a guide for engineers to consider (see list of standards and

frameworks below).

As we know, different clients and stakeholders will have different aims and needs. It is important to note that not all factors will be material to all clients and their capital project requirements.

Prioritising and evaluating the risk profile and materiality of various ESG topics is crucial for capital projects to proactively approach ESG and ensure project and owner success. Advancing sustainability is at the heart of everything that RPEQs do. Our leadership approach to sustainable development needs to be founded on an understanding of our responsibility towards project partners, staff, society and the environment.

To attain sustainable infrastructure growth and focus our approach to using an ESG framework, as leaders we need to be fully committed to the promotion and delivery of sustainability principles.

Standards have been developed globally to provide RPEQs with guidelines on:

- Investment and risk management frameworks and

- Reporting Frameworks

Infrastructure asset owners and engineers have many standards to pick from, in relation to ESG, based on their specific objectives, which range from socially responsible investment, sustainable investment to impact investment.

AS A RPEQ, WHAT’S IN IT FOR ME?

The integration of ESG into projects and company strategy can be both a source of protection and opportunity for value creation because these factors are directly linked to:

Risk management:

- Avoiding project and business interruption, cost overrun, project profit margin impact and withdrawal of operating permits

- Avoiding project and business legal risks, significant remedial actions and insurance penalties

- Avoiding project and business reputational damage (by managing the value chain and other environmental and social issues)

- Anticipating regulatory changes that could affect project success and the firm’s operations (CO2 quotas, declarations, etc.) or even the future prohibition of certain products and / or their uses

- ESG can directly affect project risk, which in turn may impact loan terms and rates, or result in higher CAPEX and OPEX affecting the return on investment

Cost reduction:

- Creation of an action plan to optimise and manage energy and waste

- Reassessment of the value chain in order to take ESG criteria into account (optimisation of greenhouse gas emissions, reduction in loss of raw materials)

- Definition of responsible purchasing ESG criteria

Consideration of new business models:

- Launch of new products and services addressing new customer requests for a responsible offer

- Identification of new markets / investments (positive impact funds, circular economy, climate change)

- Innovation leverage through eco-design

The attractiveness of our projects and businesses to clients and stakeholders (employees, suppliers, customers and investors):

- Mechanism to improve talent engagement and retention through the integration of ESG criteria into the company’s vision and values

- Response in line with calls for tender, which increasingly involve ESG criteria in the selection

- Better perception of companies incorporating ESG criteria into their strategies

- Investors more inclined to select infrastructure projects with ESG performance commitments

HOW RPEQS CAN SHAPE THE FUTURE BY INTEGRATING IMPACT IN INFRASTRUCTURE DESIGN

As many of us will be experiencing now through our interactions with clients and customers, there has never been a better and more appropriate time to integrate impact into infrastructure investment design, strategies and operations.

To do so is to create a more resilient economy for communities, and future generations. Among the main highlights RPEQs can consider in shaping the future are:

- Infrastructure is a sustainability and resilience enabler and represents interconnected long-term value for the entire stakeholder spectrum

- Huge amounts of capital need to be deployed in new infrastructure and revamping of existing assets to support the emergence and deployment of a sustainable economy. These new investment needs represent promising opportunities, assuming they can deliver attractive, risk-adjusted returns, which should be the case as:

- Sustainability and risk management have a lot in common when it comes to infrastructure investment and are strategic for investors as they determine the long-term value of these assets. This goes beyond the well known concept of carbon-intensive stranded assets as even green assets can become stranded if, for instance, they do not address adaptation considerations

- Societal, market and technological shifts now offer a plethora of unprecedented opportunities for asset managers to achieve attractive returns, deploy investments and deliver higher impacts

- Large asset owners’ recent commitments to reallocate capital to sustainable projects and activities are creating a large demand for sustainable assets

This is just the beginning of an evolution, paving the way to an engineering sector-wide transformation, with ESG impact assessment becoming a mainstream requirement for all infrastructure investment. RPEQs have a significant

role to play in the full lifecycle of infrastructure design through to decommissioning. ESG issues are relevant to all

RPEQs, regardless of their specific governmental program requirements, clients, customers or firms they work with. As the governance component of ESG becomes a greater focus, engineers will need to consider how (or should) they assign specific oversight for particular ESG issues.

As BHP’s chair noted in the August 2021 issue of Company Director (pp. 16) –

There are higher expectations of companies and you can argue whether that is right or wrong, but you need to respond to reality. Community patience is short, expectations for accountability are high and stakeholders aren’t afraid to wade in on issues. The level of scrutiny is not going to get easier.

Queensland should be proud of its achievements in managing ESG risk factors and the state government is committed to delivering further progress in this area. The state government is also focused on identifying new ESG opportunities that will deliver more sustainable outcomes for the people of Queensland and welcomes the opportunity to further engage with RPEQs, investors, and stakeholders on our collective ESG credentials and opportunities.

For more information on the Queensland Government’s approach to ESG visit www.treasury.qld.gov.au/programs-andpolicies/esg-statement.

REFERENCES

[1] and [2] McKinsey Quarterly, November 2019 – Five Ways that ESG creates value https://www.mckinsey.com/~/media/McKinsey/Business%20Functions/Strategy%20and%20Corporate%20Finance/Our%20Insights/Five%20ways%20that%20ESG%20creates%20value/Five-ways-that-ESG-creates-value.ashx

[3] https://assets.b-capitalpartners.com/media/documents/2020/03/03/19-04-wwf.pdf

[4] https://www.treasury.qld.gov.au/programs-and-policies/esg-statement/

[5] Hooper, N. (2021). Leading in the age of ESG. Company Directory, 1 August 2021, pp. 6.

CHRISTOPHER EDWARDS

Community representative

Mr Edwards was appointed to the Board in 2019. Mr Edwards has over 20 years’ experience in nonexecutive director roles, as an executive with RPS Group, PricewaterhouseCoopers and Hatch Associates he developed global strategy, governance and assurance experience in the resources industry, infrastructure, environment and planning, commercial, banking and government sectors.

MY ACCOUNT

MY ACCOUNT